Why Installing a Home Security System Can Save You on Insurance Costs

Installing a home security system does more than protect your family and belongings—it can also lead to significant savings on your homeowners insurance. Insurance companies recognize the value of security measures and often offer discounts to policyholders with alarm systems, surveillance cameras, and smart home devices.

In this guide, we’ll break down how security systems impact insurance premiums, what discounts you may qualify for, and additional strategies to reduce your insurance costs.

How Much Can You Save on Home Insurance with a Security System?

According to Consumer Affairs, homeowners in the U.S. pay an average of $146 per month for insurance. However, those who install a security system can reduce their premiums by up to 15%, translating to annual savings of approximately $263.

Source: Consumer Affairs

Home Security Discounts You May Qualify For

| Feature | Discount Range | Description |

|---|---|---|

| Burglar Alarms (Monitored) | 5% to 20% | Monitored systems that alert authorities often receive the highest discounts. |

| Home Security Cameras | Up to 10% | Adding a security camera can reduce premiums, with higher savings for monitored systems. |

| Fire Alarms and Smoke Detectors | 2% to 10% | Discounts for systems that notify fire departments, especially when monitored. |

| Deadbolt and Window Locks | 2% to 5% | Basic security improvements like strong locks offer smaller discounts. |

| Video Surveillance and Cameras | 5% to 10% | Discounts for cameras, especially if part of a monitored system. |

| Smart Home Devices | 5% to 10% | Savings for devices like smart doorbells and thermostats that enhance home security. |

| Fire Sprinkler Systems | 5% to 15% | Significant discounts for systems that activate during a fire to limit damage. |

| Carbon Monoxide Detectors | 2% to 5% | Small discounts for detectors, especially when part of a monitored system. |

| Water Leak Detection Systems | 2% to 5% | Discounts for systems that detect and prevent water damage. |

Source: National Association of Insurance Commissioners (NAIC)

How to Maximize Your Insurance Savings

Beyond installing a security system, you can further lower your homeowners insurance premiums with these strategies:

1. Increase Your Deductible

Raising your deductible reduces your monthly premium. Just ensure you have enough savings to cover any out-of-pocket expenses in case of a claim.

2. Bundle Home and Auto Insurance

Many insurers offer discounts when you combine your homeowners and auto policies with the same company.

3. Maintain a Good Credit Score

Insurance providers often use credit scores to assess risk. A higher score can lead to lower premiums.

4. Review and Adjust Your Coverage

Regularly evaluate your policy to ensure you’re not overpaying for unnecessary coverage.

5. Shop Around for the Best Rates

Compare quotes from different insurers to find the best policy that offers both security discounts and competitive rates.

Choosing the Right Security System: Kangaroo Home Security

When selecting a security system, Kangaroo Home Security offers a range of features and options that cater to various needs. Here’s a guide to help you understand what Kangaroo Home Security provides and how it might fit into your home protection strategy.

Essential Features

Motion Detection: Kangaroo’s system includes motion sensors that alert you to any movement within the monitored area. This feature is crucial for detecting potential intruders in real time.

Video Surveillance: Kangaroo offers indoor and outdoor cameras with high-definition video, night vision, and motion detection capabilities. These cameras help you keep an eye on your property 24/7.

Kangaroo Doorbells: The Kangaroo Photo Doorbell and Video Doorbell Cameras enhance your security by offering real-time photo stitches, video, and two-way audio, so you can see and speak to anyone at your door from anywhere.

Entry Sensors: The system comes with door and window sensors that monitor entry points and send alerts if they are opened unexpectedly.

Coverage Area

Size of Property: Kangaroo systems are designed to be flexible, making them suitable for various property sizes. You can choose a package that covers all entry points and vulnerable areas of your home.

Expandable Options: Kangaroo offers the ability to expand your system with additional sensors, cameras, or other devices, allowing you to scale the coverage as needed.

Ease of Installation and Use

DIY Installation: Kangaroo provides a DIY installation option, making it easy for homeowners to set up the system without professional help. The process is designed to be straightforward and user-friendly.

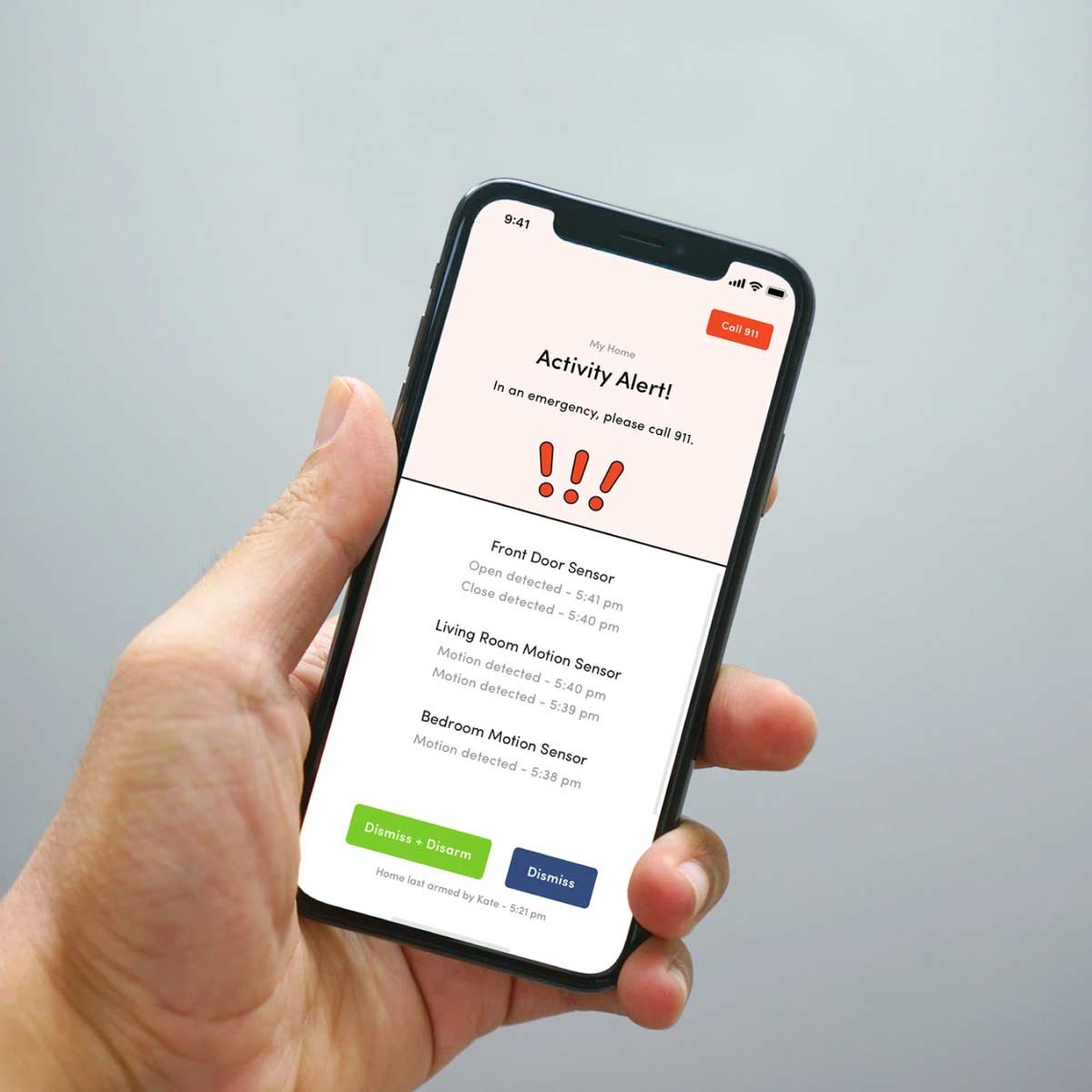

User-Friendly Interface: The system includes an intuitive app that allows you to manage and monitor your security system from anywhere. The Kangaroo app provides real-time alerts, video feeds, and system controls.

Related Contents:

6 Ways to Save on Homeowners Insurance and Lower Your Premium

Guide to Homeowners Insurance Discounts For Your New Home

Smart Homes, Smarter Savings: Big Discounts on Your Homeowners Insurance

Unlock Insurance Savings with Kangaroo’s Dory Insurance Concierge

At Kangaroo’s Dory Insurance Concierge Service, our goal is to help you get the most out of your home insurance. We facilitate direct communication between Kangaroo Home Security and your insurance provider to verify your eligibility for potential discounts.

By integrating Kangaroo’s state-of-the-art security systems into your home, you could see a reduction in your homeowners insurance premiums. This proactive step not only enhances your home’s security but also contributes to significant financial savings.

Securing comprehensive insurance coverage for your home can be straightforward and cost-effective. By exploring available discounts whether through bundling your home and auto policies or leveraging advanced security systems like Kangaroo, you can protect your home and enjoy lower premiums.

Dory Reviews and Testimonials: How Kangaroo Enhanced Our Insurance Savings

“Kangaroo made it effortless to save on my insurance. I now enjoy both peace of mind from my security system and extra funds to help manage inflation. Thank you!”

— Brandon, Dory Customer“Wow! I answered a few questions and am now saving an additional $64. Simple, fast, and easy!”

— Jeff, Dory Customer“The process was so seamless that I don’t even recall taking any action to get this discount, but it was great to receive it!”

— Mital, Dory Customer“I saved $21 on my home insurance just by clicking a button. Kangaroo handled all the details, including contacting my insurer to activate the discount!”

— Maria, Dory Customer“Everyone involved was extremely helpful. From State Farm to Kangaroo, submitting for the discount was a breeze.”

— Nat, Dory Customer“The process was quick and easy—thanks for helping me save money on my insurance!”

— Jackson, Dory Customer

Remember, every homeowner’s situation is unique, so it’s important to tailor your approach to fit your specific needs. Implementing these strategies can help you achieve significant savings and provide peace of mind, knowing that your home is well-protected.

Reducing your homeowners insurance premiums doesn’t have to be a daunting task. By taking proactive steps such as increasing your deductible, installing a comprehensive security system like Kangaroo Home Security, and bundling your home and auto insurance, you can effectively lower your premiums while maintaining essential coverage.

Q&A: Maximizing Insurance Savings with Kangaroo Home Security and Dory Insurance Concierge

-

Kangaroo Home Security reduces the risk of theft and damage, which can qualify homeowners for discounts on their home insurance premiums. Many insurance companies recognize these systems as effective preventative measures and offer savings ranging from 5–15%.

-

Dory Insurance Concierge is a service that connects policyholders with personalized insurance solutions. It helps homeowners find insurers offering discounts for using Kangaroo Home Security and guides them in understanding policy options, coverage details, and deductibles.

-

While it doesn’t directly lower the deductible, having a Kangaroo security system can reduce claim frequency by preventing incidents like theft or damage, potentially resulting in favorable terms from your insurer.

-

Yes, an insurance agent can provide valuable insights into which insurers offer discounts for security systems like Kangaroo Home Security. They can also help you customize your homeowners policy to maximize savings.

-

While Kangaroo systems primarily address theft and property damage, they can complement flood sensors to reduce risks associated with water damage. Insurers may reward this comprehensive approach with savings on flood insurance coverage.

-

Rebuild coverage ensures your home can be restored to its original condition after a covered loss. Adding Kangaroo Home Security can lower insurance costs, freeing up budget for better rebuild coverage.

-

Security systems like Kangaroo provide video evidence and monitoring services that strengthen your claim documentation, making it easier for insurers to process and approve claims.

-

While Kangaroo Home Security focuses on theft prevention, additional features like cameras and sensors can document roof damage from events like storms. This evidence can streamline the claims process with your insurance company.

-

Insurers evaluate the reduced risk of loss due to systems like Kangaroo Home Security. These calculations typically result in lower insurance premiums and improved terms for the policyholder.

-

By enhancing home safety, Kangaroo systems lower risks and insurance costs. This makes it easier to secure comprehensive coverage while maintaining affordable premiums.

-

Absolutely! Dory Insurance Concierge works with agents and insurers to ensure your policy reflects the security system discounts you’re eligible for, optimizing coverage and reducing costs.