How to Save Money on Renters Insurance in 2025: Top Tips & Tools for Smart Renters

What Is Renters Insurance and Why Do You Need It?

Renters insurance is a type of policy designed to protect your personal belongings, provide liability coverage, and offer temporary living expenses if your rental becomes uninhabitable. While your landlord’s policy covers the building, it doesn't protect you or your stuff.

What Does Renters Insurance Cover?

Personal Property Coverage – Protects belongings from theft, fire, and water damage.

Liability Coverage – Covers legal and medical costs if someone gets hurt in your rental.

Additional Living Expenses (ALE) – Helps pay for temporary housing and meals after a covered incident.

How to Save on Renters Insurance: 10 Smart Strategies

Even though renters insurance is affordable—averaging just $15–$30/month—you can save even more with these expert-approved strategies.

1. Bundle Your Policies:

If you also have auto insurance, consider bundling it with your renters insurance from the same provider. Many insurance companies offer attractive discounts for bundling multiple policies, allowing you to save on both. It's a win-win situation – streamlined billing and reduced costs.

2. Increase Your Deductible:

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Opting for a higher deductible can significantly lower your monthly premium. However, it's crucial to strike a balance. Make sure you can comfortably afford the deductible in case you need to file a claim.

3. Install Security Devices:

Many insurance companies offer discounts for renters who take proactive steps to protect their apartments. Installing security devices like smoke detectors, burglar alarms, and even smart home security systems like Kangaroo can demonstrate your commitment to safety and potentially earn you a discount on your premium.

4. Maintain a Good Credit History:

In most states, your credit history can influence your insurance premium. Maintaining a good credit score demonstrates financial responsibility and can lead to lower insurance rates.

5. Ask About Discounts:

Don't hesitate to inquire about additional discounts that may be available. Some insurers offer discounts for:

Non-smokers

Seniors

Students with good grades

Occupations (e.g., teachers, nurses, etc.)

Loyalty (staying with the same insurer for a certain period)

Claims-free history

6. Review Your Coverage Regularly:

As your life changes, so do your insurance needs. Periodically review your renters insurance policy to ensure it still provides adequate coverage for your personal property and liability. You may need to adjust your coverage limits if you acquire new valuable items or if your living situation changes.

7. Understand Your Policy:

Take the time to thoroughly read and understand your renters insurance policy. Pay attention to coverage limits, exclusions, and any special endorsements you may need for specific items like jewelry or electronics. If you have any questions, don't hesitate to contact your insurance agent or the insurance company directly.

8. Consider Additional Coverage Options:

While standard renters insurance covers a wide range of perils, you may want to consider additional coverage options for specific needs. These could include:

Flood insurance: If you live in a flood-prone area, consider purchasing flood insurance to protect your belongings from flood damage.

Earthquake insurance: If you live in an earthquake-prone area, consider adding earthquake insurance to your policy.

Scheduled personal property coverage: This provides additional coverage for high-value items like jewelry, art, or collectibles that may exceed the limits of your standard personal property coverage.

Identity theft protection: Some insurers offer identity theft protection as an add-on to your renters insurance policy.

9. Choose the Right Insurance Provider:

Not all insurance companies are created equal. It's essential to choose a reputable insurer with a strong financial rating and excellent customer service. Research different companies, read reviews, and compare quotes to find the best fit for your needs.

10. Work with an Insurance Agent:

An insurance agent can be a valuable resource in helping you understand your coverage options, find the best renters insurance for your needs, and navigate the claims process if necessary. Consider working with an independent agent who can compare quotes from multiple insurers to find you the best deal.

Kangaroo: Your Partner in Apartment Security and Savings

Kangaroo offers affordable and easy-to-install home security solutions that are perfect for renters. Their range of devices, including motion sensors, door/window sensors, and indoor and outdoor cameras, can help deter theft and provide valuable evidence in case of a break-in.

Kangaroo Protect Plans: Added Benefits

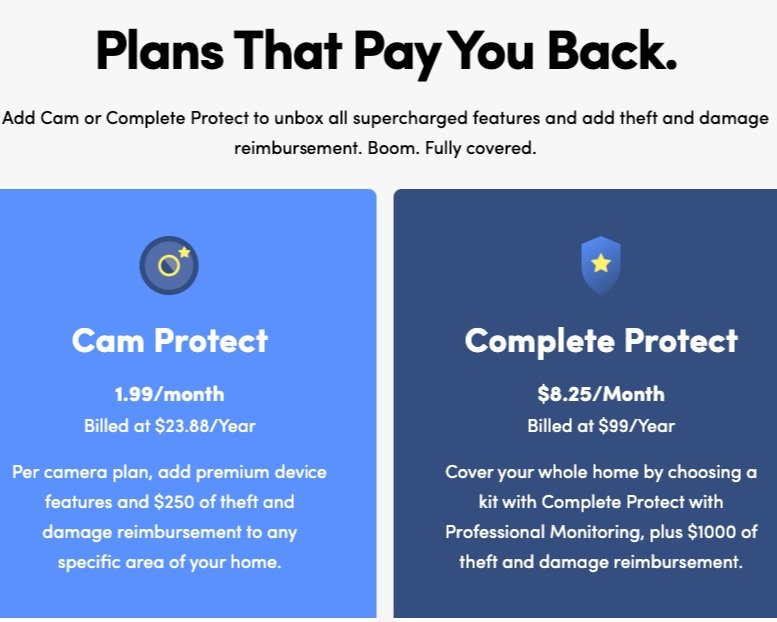

Cam Protect: Safeguard your Kangaroo devices with theft and damage coverage, plus unlock premium features like Person Detection and Full Event Capture. Reimburse up to $250 annually

Complete Protect: Enjoy comprehensive whole-home coverage, including 24/7 professional monitoring and up to $1000 of theft and damage reimbursement (up to 2 claims per year, max $500 per claim, covers fire, water, or smoke damage).

Dory: Your Insurance Discount Assistant

Kangaroo's Dory service can help you maximize your renters insurance discounts. By analyzing your current policy and identifying potential savings opportunities, Dory can help you save up to 20% annually on your premiums.

Hear from Satisfied Dory Users

"Kangaroo saved us $131 and did all the leg work for me! Thanks!" - Rachael, Dory Verified Customer

"Super easy and super helpful." - Patricia, Dory Verified Customer

"Thanks for letting me know I was eligible for the discount." - Robert, Dory Verified Customer

"Wow! I just answered a few questions and now I’m saving an additional $64! Simple, Fast & easy!" - Jeff, Dory Verified Customer

"The Kangaroo specialist was so helpful, accommodating and very informative on our issue and helped us to get a discount on our insurance that we didn't even know existed, thank you" - Leo, Dory Verified Customer

"I didn’t even know this was possible until I contacted kangaroo and I was offered! They contacted my insurance company and was able to save me 10% overall." - Spree, Dory Verified Customer

Renters Insurance by the Numbers

| Statistic | Value |

|---|---|

| Percentage of renters with insurance (2014) | 37% |

| Decrease in average premium (2017) | 2.7% |

| Average annual premium in the U.S. (2017) | $180 |

| Lowest average annual premium (North Dakota, 2017) | $120 |

| Common deductible amount | $500 |

| Percentage of renters under 30 (2017) | 50% |

(statistics c/o Policygenius)

This table provides a concise overview of key renters insurance statistics, highlighting its affordability and the potential for savings. It also emphasizes the importance of considering this coverage, especially for younger renters who make up a significant portion of the rental population.

Average Renters Insurance Costs by State: Annual and Monthly Breakdown

These averages are based on general figures and can vary based on factors like coverage level, location within the state, and personal factors like credit scores.

| State | Average Annual Cost | Average Monthly Cost |

|---|---|---|

| Alabama | $235 | $20 |

| Alaska | $168 | $14 |

| Arizona | $194 | $16 |

| Arkansas | $220 | $18 |

| California | $180 | $15 |

| Colorado | $165 | $14 |

| Connecticut | $180 | $15 |

| Delaware | $170 | $14 |

| Florida | $195 | $16 |

| Georgia | $215 | $18 |

| Hawaii | $185 | $15 |

| Idaho | $160 | $13 |

| Illinois | $175 | $15 |

| Indiana | $185 | $15 |

| Iowa | $160 | $13 |

| Kansas | $165 | $14 |

| Kentucky | $200 | $17 |

| Louisiana | $235 | $20 |

| Maine | $160 | $13 |

| Maryland | $170 | $14 |

| Massachusetts | $195 | $16 |

| Michigan | $195 | $16 |

| Minnesota | $165 | $14 |

| Mississippi | $220 | $18 |

| Missouri | $175 | $15 |

| Montana | $160 | $13 |

| Nebraska | $165 | $14 |

| Nevada | $180 | $15 |

| New Hampshire | $165 | $14 |

| New Jersey | $170 | $14 |

| New Mexico | $190 | $16 |

| New York | $200 | $17 |

| North Carolina | $200 | $17 |

| North Dakota | $160 | $13 |

| Ohio | $185 | $15 |

| Oklahoma | $220 | $18 |

| Oregon | $160 | $13 |

| Pennsylvania | $175 | $15 |

| Rhode Island | $185 | $15 |

| South Carolina | $200 | $17 |

| South Dakota | $165 | $14 |

| Tennessee | $205 | $17 |

| Texas | $210 | $18 |

| Utah | $160 | $13 |

| Vermont | $160 | $13 |

| Virginia | $170 | $14 |

| Washington | $170 | $14 |

| West Virginia | $185 | $15 |

| Wisconsin | $160 | $13 |

| Wyoming | $160 | $13 |

FAQs About Renters Insurance

-

No, but landlords can legally require it as part of a lease.

-

Annually or after any major life event (like moving or buying valuables).

-

To ensure you're getting the best coverage, best price, and all available discounts.

-

It protects your finances if you’re found responsible for injuries or damage on the property.

Take Action Now: Protect What Matters & Save More

Start by comparing quotes and reviewing your current policy. Then maximize your savings with Dory and protect your space with Kangaroo’s smart security products.

Explore Kangaroo Home Security for Renters

Use Dory to Save on Renters Insurance