Home Insurance Claims for Water Damage: Top Tips

Water damage can be a homeowner's worst nightmare, leading to unexpected costs and significant disruption. Understanding your home insurance policy and the claims process is essential for a smooth recovery. This guide provides actionable tips to help you file a successful claim, prevent future incidents, and ensure your home is restored quickly and efficiently.

Home Insurance Water Damage Claims: Your Comprehensive Guide

What Does Water Damage Coverage Mean?

Your homeowner's policy covers sudden and accidental water-related events.

Examples include burst pipes, appliance overflows, water heater leaks, storm leaks, and plumbing malfunctions.

Note: Standard policies typically exclude flooding from external sources (rivers, heavy rain), requiring separate flood insurance. Gradual damage (mold from poor maintenance) is also often excluded.

Does Home Insurance Cover Leaks?

Yes, for sudden and accidental leaks.

Typically covers personal property damage (contents insurance).

Excludes gradual leaks due to wear and tear.

Step-by-Step Guide: Filing a Water Damage Claim

Filing a water damage claim under your homeowner's insurance policy can seem overwhelming, but following the right steps will ensure a smoother process. Here’s how to make a water damage claim:

1. Document the Damage Immediately:

Capture photos and videos of all affected areas.

Include damaged personal property and structural issues.

2. Prevent Further Damage:

Turn off the water supply, cover leaks, and remove standing water.

Insurers expect you to take reasonable steps to mitigate damage.

3. Review Your Homeowners Insurance Policy:

Understand your coverage, exclusions, deductibles, and limits.

Understanding Home Insurance Policy Terms

4. Notify Your Insurance Company Promptly:

Use their 24-hour hotline or online portal.

Provide detailed information about the incident.

5. Schedule an Inspection with an Adjuster:

Show them the affected areas and provide repair estimates.

6. Work with Licensed Contractors:

Obtain multiple estimates and share them with the adjuster.

7. Follow Up on Your Claim Regularly:

Stay in contact and provide any additional information needed.

Top 10 Tips to Prevent Water Damage in Your Home

Use Water Detectors

Consider installing water leak detectors near potential problem areas, such as water heaters, washing machines, and under sinks. These devices can alert you to leaks before they cause significant damage, allowing you to act quickly.Regularly Inspect and Maintain Plumbing

Check your pipes, faucets, and appliances (like dishwashers and washing machines) for leaks or signs of wear. Replace any old or corroded pipes and fix leaks promptly to prevent water damage.Monitor Water Pressure

High water pressure can stress your plumbing and lead to leaks. Use a water pressure gauge to check the pressure; it should typically be between 40 and 60 psi. If it’s too high, consider installing a pressure regulator.Install a Sump Pump

If your home is prone to flooding, install a sump pump in your basement or crawl space. This device helps remove excess water during heavy rain or floods, preventing damage to your home.Seal Cracks and Openings

Inspect your home's foundation, windows, and doors for cracks or gaps. Seal these openings with caulk or weatherstripping to prevent water intrusion, especially during heavy rain.Clean Gutters and Downspouts

Regularly clean your gutters and downspouts to ensure proper drainage. Clogged gutters can cause water to overflow and damage your roof, siding, and foundation. Direct downspouts away from your home to avoid pooling.Maintain Your Roof

Inspect your roof for damaged or missing shingles and address any issues promptly. Regular maintenance can prevent leaks and water damage to your home’s interior.Ensure Proper Landscaping

Grade your landscaping away from your home’s foundation to promote drainage. Avoid planting trees or shrubs too close to your house, as their roots can damage pipes and cause leaks.Know Your Home Insurance Coverage

Review your homeowners insurance policy to understand what types of water damage are covered. Consider adding flood insurance if you live in a flood-prone area.Educate Family Members

Make sure everyone in your household knows how to shut off the main water supply in case of a plumbing emergency. Quick action can prevent significant damage.

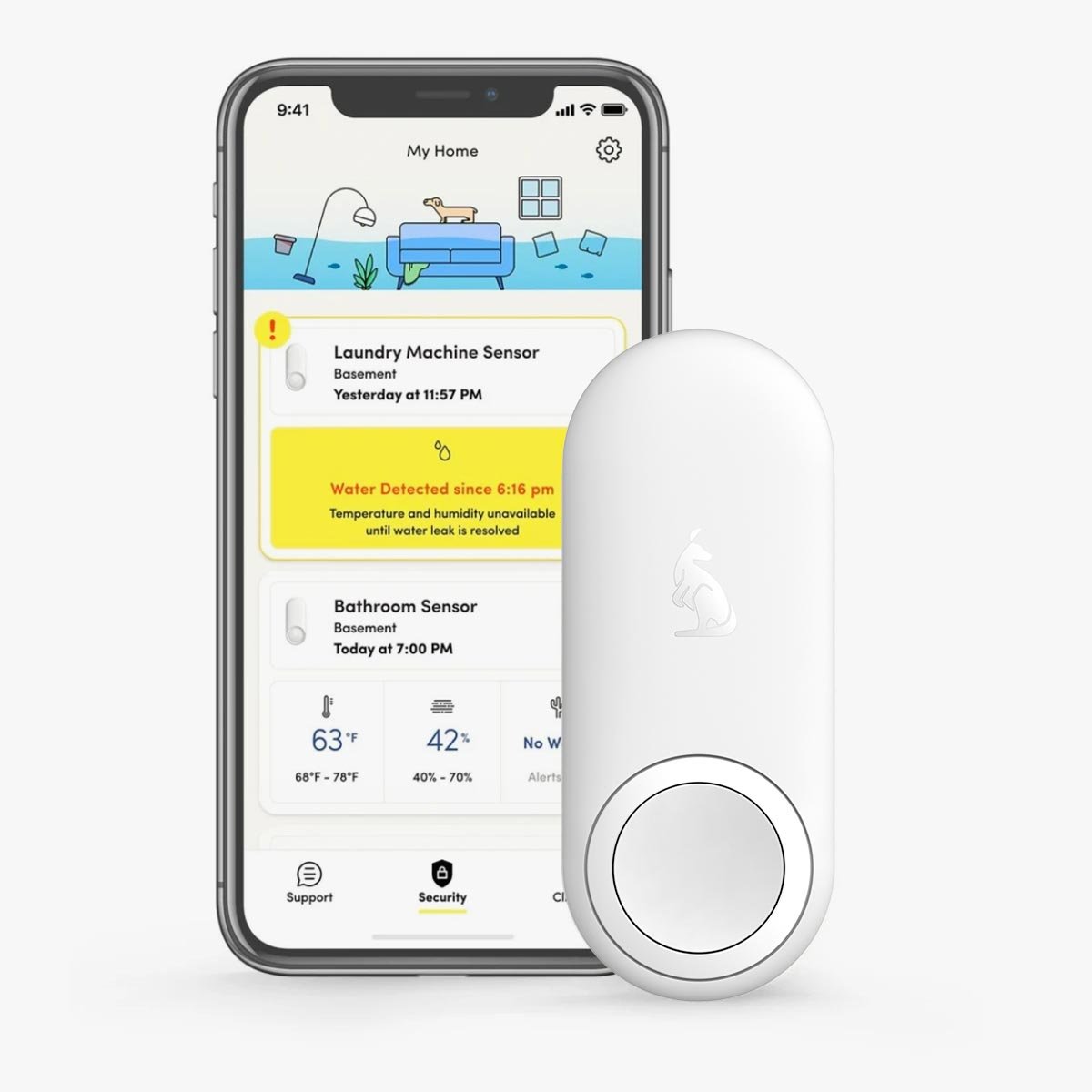

Kangaroo Water + Climate Sensor is the Best Choice for Home Protection

The Kangaroo Water + Climate Sensor is an outstanding water leak detector for protecting your home. Here’s why:

Comprehensive Monitoring

It detects leaks and monitors temperature and humidity, offering protection from water damage, freezing pipes, and mold growth.Easy DIY Installation

With simple, wireless setup, the sensor fits into tight spaces and sends real-time alerts to your smartphone for immediate action.Affordable and Effective

It offers reliable performance at a budget-friendly price, making it ideal for both renters and homeowners.Proactive Alerts

Smart notifications ensure quick response to leaks or climate changes, preventing costly damage.Perfect for Renters and Homeowners

Its portability and smart home integration make it a versatile choice for long-term or temporary use.

Great Product

"This is a great product. It’s easy to use and perfect for traveling. It effectively detects both water and humidity, and the price is right."

— Melyna, Walmart Verified Purchase

Must Have!

"This is a must-have! I keep one in my basement and bought a second for a rental property. It provides extra protection and peace of mind."

— Shalia, Walmart Verified Purchase

Good to Keep You Informed

"This little product gives great peace of mind. It’s a fantastic idea for monitoring sump pumps and humidity levels in my basement. The setup was simple and it’s working well so far."

— Lexi, Walmart Verified Purchase

Protect Your Home and Save with Kangaroo’s Complete Plan

Strengthen your home’s protection and reduce costs by bundling Kangaroo’s Water + Climate Sensor with the Kangaroo Complete Plan. This affordable package offers advanced water and climate monitoring along with added benefits from Kangaroo’s comprehensive service plan.

By subscribing to the Kangaroo Complete Plan, you receive features designed to protect your home and finances. One key advantage is damage reimbursement, providing compensation if water damage occurs due to leaks. This added coverage offers peace of mind, ensuring you’re financially protected from water-related incidents.

The Complete Plan works seamlessly with the Water + Climate Sensor, helping you detect and address issues early, preventing major problems, and keeping your home secure.

Effortless Claim Filing with Kangaroo: A Step-by-Step Guide

Filing a claim with Kangaroo is designed to be straightforward and efficient, ensuring you receive the reimbursement you deserve with minimal hassle. Here are the essential steps to guide you through the process:

Submit Your Claim Quickly: Ensure you file your claim within 5 days of the incident.

Complete the Claim Form: Fill out the claim form provided at this link.

Provide Required Documentation:

For property damage: Include a repair invoice or estimate.

Attach at least three photos of the damage taken from different angles.

For incidents related to burglary, break-ins, or damage caused by a person: Include a police report.

Review Period: Allow 24-48 hours for feedback regarding any missing documents or additional information needed.

Claim Reimbursement: Once all required information is submitted, your claim will be processed, and reimbursement will be issued within 72 hours.

Reimbursement Options: Payments can be made through PayPal or ACH Bank/Wire Transfer.

Kangaroo Water Claim Approval Trend

At Kangaroo, we strive to make the claims process as smooth as possible for our customers. When a water claim is filed, we assess the documentation provided to ensure it meets the necessary criteria for approval. Our efficient review system allows us to quickly evaluate claims, and we prioritize transparency throughout the process. Our dedicated claims team is available to assist you with any questions and to provide updates on the status of your claim. By maintaining high approval rates, we aim to deliver timely reimbursements, helping you recover from water-related incidents with minimal hassle.

Conclusion

Understanding water damage claims and taking preventative measures is crucial for protecting your home. Utilize tools like the Kangaroo Water + Climate Sensor for added security. Stay informed about your insurance coverage to ensure you are fully protected.

Don't let water damage catch you off guard! Protect your home today. Click Here to Get Your Kangaroo Water + Climate Sensor and gain peace of mind. Have questions about your home insurance coverage? Contact Our Experts Now for personalized advice.

Q&A on Water Damage and Insurance

-

Homeowners insurance usually covers water damage from sudden and accidental events, such as a burst pipe or a roof leak. However, it may not cover damage from flooding unless you have a separate flood insurance policy.

-

Mold damage may be covered under your homeowners insurance policy if it results from a covered peril, like a water leak. However, many policies have specific exclusions for mold, so it’s essential to review your coverage details.

-

To file an insurance claim for water damage, contact your insurance company as soon as possible. Document the damage with photos, and provide details about the incident when filing your home insurance claim. Be prepared to pay your deductible, as it will be deducted from the total claim amount.

-

Dwelling coverage protects the structure of your home from covered risks, such as water damage from heavy rain or leaks. Personal property coverage protects your belongings, like furniture and electronics, in the event of damage from a covered peril.

-

If your claim is denied, review your homeowners insurance policy to understand the reason for the denial. You can appeal the decision by providing additional evidence or documentation to support your claim. Consider contacting your insurer for clarification or seeking assistance from an insurance agent.