Affordable Virginia Homeowners Insurance in 2025

Virginia, with its rich history and diverse landscapes, remains a wonderful place to call home in 2025. However, like any homeowner, you need to protect your investment with the right insurance coverage. Fortunately, homeowners insurance in Virginia tends to be more affordable than the national average. Let’s explore the current insurance landscape in Virginia and discover some tips to secure the best and most affordable coverage for your home.

What is the average cost of homeowners insurance in Virginia?

As of the most recent data available (2024), the average annual cost of home insurance in Virginia is approximately $1,545 for a policy with $300,000 in dwelling coverage. This remains considerably lower than the national average, making Virginia an attractive state for homeowners seeking affordable insurance. Updated figures for 2025 are anticipated to follow similar trends but may reflect slight increases due to inflation and other market factors.

Who offers the Best Homeowners Insurance rates in Virginia for a $400k home?

Below is a list of companies with competitive rates for a $400,000 home as of 2024. These rates may provide a starting point as you evaluate 2025 options:

| Company | Average Rate for $400K Dwelling |

|---|---|

| Allstate Insurance | $1,462 |

| Erie Insurance Group | $1,445 |

| Nationwide | $1,374 |

| State Farm Insurance Company | $1,341 |

| Travelers Companies, Inc. | $1,152 |

c/o clearinsurance

Note: Rates may vary in 2025 due to updates in policies, inflation, and regional factors.

Cost Variations Across Virginia

Even within Virginia, insurance premiums can fluctuate significantly depending on where you live.

Rural Areas: Homes in rural areas generally enjoy the lowest premiums due to lower crime rates and reduced risk of fire and theft.

Suburban Areas: Suburban areas typically fall somewhere in the middle, offering a balance of affordability and access to amenities.

Urban Areas: Urban areas, especially those near the coast or with higher crime rates, tend to have higher premiums due to increased risks like hurricanes, flooding, and theft.

For example, the average annual premium in Virginia Beach is $2,451, significantly higher than the state average, while homeowners in Leesburg pay an average of $1,210 per year.

Average Insurance Premiums in Virginia

| Type | City | Average Insurance Premium | Annual Rate | Monthly Rate |

|---|---|---|---|---|

| RURAL | Lexington | $1,274 | $106 | |

| RURAL | Abingdon | $1,384 | $115 | |

| RURAL | Floyd | $1,360 | $113 | |

| RURAL | Farmville | $1,579 | $131 | |

| RURAL | Wytheville | $1,366 | $113 | |

| SUB-URBAN | Leesburg | $1,210 | $100 | |

| SUB-URBAN | Vienna | $1,256 | $104 | |

| SUB-URBAN | Chesapeake | $2,158 | $180 | |

| SUB-URBAN | Midlothian | $1,460 | $121 | |

| SUB-URBAN | Herndon | $1,253 | $104 | |

| URBAN | Richmond | $1,510 | $125 | |

| URBAN | Virginia Beach | $2,451 | $204 | |

| URBAN | Norfolk | $2,218 | $184 | |

| URBAN | Arlington | $1,226 | $88 | |

| URBAN | Alexandria | $1,218 | $89 |

Factors Influencing Insurance Rates in Virginia

Several key factors influence homeowners insurance rates in the state:

Location: Proximity to coastlines increases the risk of hurricane and wind damage, leading to higher premiums. Homes in flood-prone areas may require additional flood insurance.

Home Age and Condition: Older homes often have outdated materials and systems, making them more susceptible to damage. Regular maintenance and updates can help mitigate these risks.

Construction Materials: Homes built with durable, fire-resistant materials may qualify for lower premiums.

Home Value & Replacement Cost: The higher the value of your home, the more it will cost to rebuild or replace, directly impacting your premium.

Credit Score: Insurers in Virginia can consider your credit score when determining your premium. Maintaining good credit can help secure lower rates.

Safety Features: Installing security systems, smoke detectors, and fire alarms can demonstrate your commitment to protecting your home and may lead to discounts.

What insurance coverage is Required in Virginia?

Homeowners insurance is not legally required in Virginia. However, mortgage lenders almost always require it as a condition of your loan to protect their investment. Even if you own your home outright, having insurance is highly recommended to safeguard your home and belongings against damage or theft.

What is the new Law for Homeowner's Insurance in Virginia?

As of 2025, Virginia continues to build upon the foundational homeowners insurance law initially implemented in 2022, with updates aimed at further enhancing consumer protections and policy clarity. These updates address the evolving needs of homeowners and ensure transparency in coverage.

Key Updates and Changes:

Minimum Standards for Policies: The law enforces clear minimum standards for homeowners insurance policies, ensuring uniform and consistent coverage across insurers. This includes a focus on protecting essential homeowner needs.

Enhanced Readability: Policies must be written in plain, easy-to-understand language. This change minimizes confusion and helps homeowners make informed decisions about their coverage.

Retention of Core Protections: The law preserves key coverages that are vital to consumers, such as dwelling, liability, and additional living expenses, safeguarding homeowners against unexpected financial burdens.

Detailed Clarifications: Ambiguities in policy language have been addressed, covering areas such as occasional rental properties, unoccupied or vacant homes, and incidental business activities within a residence.

Expanded Open Perils Coverage: Insurers are required to provide open perils coverage (also known as "all-risk" coverage) for the dwelling and other structures. This ensures coverage for any direct physical loss unless specifically excluded, offering comprehensive protection.

Flexibility in Personal Property Coverage: Homeowners can now choose between open perils coverage and named perils coverage for personal property. Open perils offer broader protection, while named perils provide coverage for specific, listed risks.

What is full coverage Insurance in Virginia?

In Virginia, "full coverage" home insurance typically includes:

Dwelling Coverage: Protects the physical structure of your home.

Personal Property Coverage: Covers belongings inside your home.

Liability Coverage: Provides financial protection if someone is injured on your property.

Medical Payments Coverage: Covers medical expenses for minor injuries sustained by guests on your property.

Additional Living Expenses (ALE) Coverage: Helps cover temporary living costs if your home becomes uninhabitable.

Trends and Changes in 2025

While specific rate data for 2025 is still emerging, some notable trends and factors may influence premiums:

Natural Disasters: Increased frequency of hurricanes and flooding could drive up costs, especially in coastal areas.

Smart Home Technology: Many insurers offer discounts for homes equipped with devices like security cameras, water leak sensors, and smart thermostats.

Eco-Friendly Upgrades: Homes with energy-efficient appliances or solar panels may qualify for additional savings.

Tips for Saving on Homeowners Insurance in 2025

Increase Your Deductible: Opting for a higher deductible can lower your premium.

Bundle Policies: Combine home and auto insurance for discounts.

Improve Your Home’s Security: Installing security systems can reduce risk and lower premiums.

Shop Around: Compare quotes from multiple insurers annually.

Maintain Good Credit: A strong credit score can lead to better rates.

Kangaroo Home Security: An Added Layer of Protection and Savings

Consider enhancing your home security with Kangaroo's affordable and easy-to-install systems. Not only can they deter theft and provide evidence in case of a break-in, but they may also qualify you for additional discounts on your homeowners insurance.

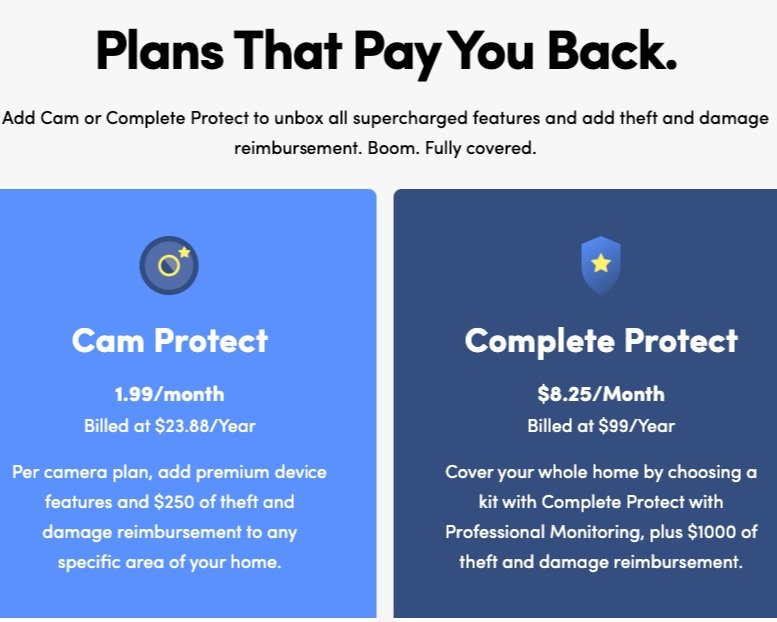

Kangaroo Cam Protect and Complete Protect Plans: These plans offer theft and damage reimbursement, covering your Kangaroo devices and even offering up to $1,000 reimbursement for stolen packages or property damage (subject to terms and conditions).

Kangaroo Dory: This free service helps you identify potential discounts on your existing home insurance policy, potentially saving you up to 20% on your annual premium.

Hear from Dory Customers

Thanks Kangaroo-impeccable! Over $51 savings per year. - Melissa, Dory Verified Savings

Thanks for letting me know I was eligible for the discount of $92/year - Robert, Dory Verified Savings

Wow! I just answered a few questions and now I’m saving an additional $64! - Jeff, Dory Verified Savings

It was seamless, I dont even remember if I took any action to get this $53 discount, but it was good to get!! - Mital, Dory Verified Savings

The entire process was satisfactory - of $154 discount - Caleb, Dory Verified Savings

Read More:

Smart Homes, Smarter Savings: Big Discounts on Your Homeowners Insurance

How to Choose the Best Homeowners Insurance Company

Just Bought a Home? Essential Theft and Damage Coverage Tips

Conclusion

Finding affordable homeowners insurance in Virginia is achievable with a little research and effort. By understanding the factors that influence rates, comparing quotes from multiple insurers, and taking advantage of available discounts, you can secure the best coverage for your home at a price that fits your budget. And with the added protection of Kangaroo Home Security and the potential savings through Dory, you can enjoy greater peace of mind knowing your home and belongings are well-protected.

Remember, it's always wise to consult with a licensed insurance agent or the Virginia Insurance Commissioner's office if you have any questions or need further assistance in navigating the complexities of homeowners insurance.

FAQs: Virginia Homeowners Insurance

-

While homeowners insurance is not legally required in Virginia, most mortgage lenders will require you to have it to protect their investment. If you have an auto loan, you'll also need to carry the state's minimum auto insurance coverage.

-

The Virginia Insurance Commissioner regulates the insurance industry in the state, ensuring that insurance companies operate fairly and comply with state laws. They also provide consumer protection and assistance to policyholders.

-

No, standard homeowner insurance policies typically do not cover flood damage. If you live in a flood-prone area, you'll need to purchase a separate flood insurance policy through the National Flood Insurance Program or a private insurer.

-

If you need to file a claim, contact your insurance company as soon as possible. They will guide you through the claim process and assign a claims adjuster to assess the damage and determine the coverage amount.

-

A deductible is the amount you, the policyholder, agree to pay out-of-pocket before your insurance company covers the remaining cost of a claim.

-

In home insurance, your deductible applies to covered perils like fire, theft, or wind damage. For example, if your home suffers $10,000 in damage from a covered event and you have a $1,000 deductible, you'll pay the first $1,000, and your insurance company will cover the remaining $9,000.

-

Research and compare multiple insurance companies based on factors like coverage options, customer service ratings, financial strength, and premium costs. You can also seek recommendations from friends, family, or an independent agent.

-

Dwelling coverage protects the physical structure of your home, including the roof, walls, foundation, and attached structures. The amount of coverage you need should be enough to rebuild your home at current construction costs. Your insurance agent can help you determine the appropriate coverage amount.